Resource Center

Webinars

From Sunk Costs to Strategic Savings: Risk & Insurance Plays to Strengthen Your Portfolio

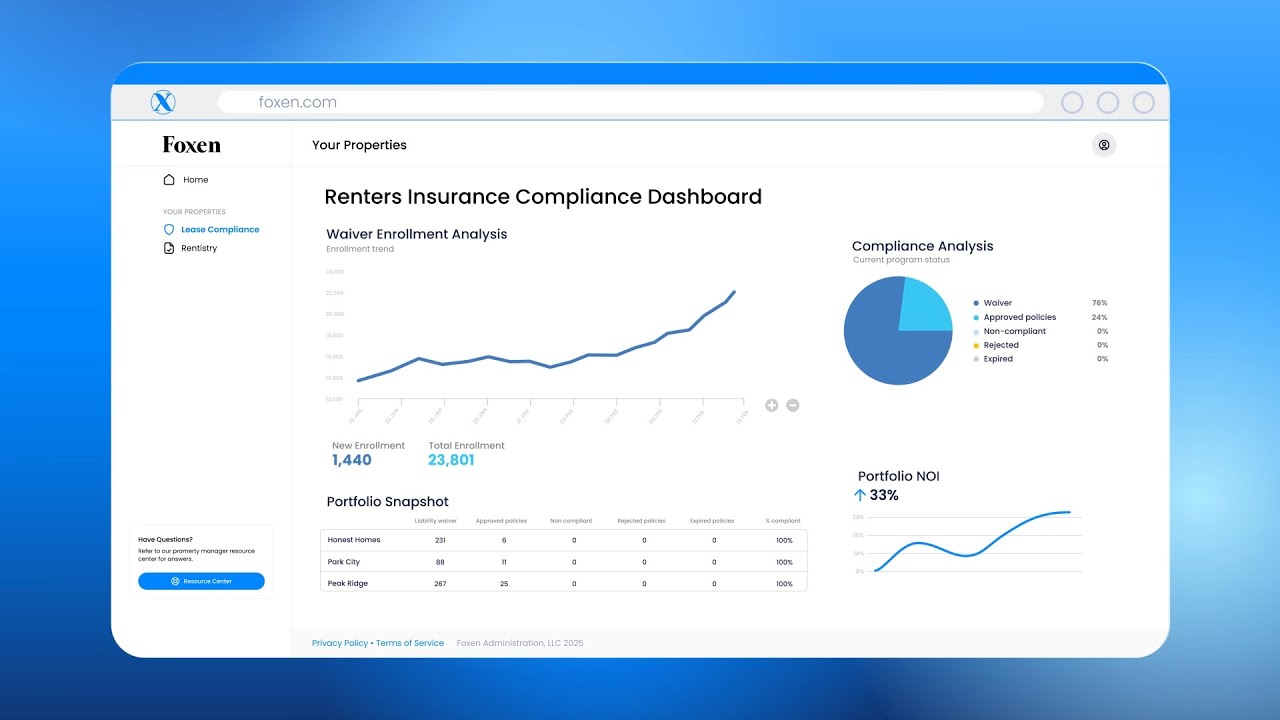

Captive insurance solutions are shifting the narrative by giving owners and operators:

- Control over program design, premiums, and claims management

- Transparency into portfolio performance without relying on carrier reporting

- The potential to generate stability, savings, and revenue through underwriting profits.

For operators looking to unlock these benefits without the complexity of building their own captive, WaiverCell provides a streamlined path. As a protected cell within Foxen’s captive, it delivers the upside of self-insurance—premium stability, claims control, compliance, and revenue opportunities—while Foxen manages the heavy lifting.

In our webinar with Interface Conference Group, Foxen’s captive insurance experts, Kelli Stiles (Chief Legal & Insurance Officer), Pete Kidd (VP of Insurance Solutions), and Ty Specht (Senior Director of Relationship Management), explore why multifamily operators need to rethink risk management.

Your Webinar Thought Leaders

Contributor

Pete Kidd

VP of Insurance Solutions at Foxen

Contributor

Kelli Stiles

Chief Legal & Insurance Officer at Foxen

Contributor

Tyler Specht

Senior Dir. of Relationship Management at Foxen

Related Resources

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Get Industry News and Updates

.png)

.png)